The FIRE Movement. What is FIRE Finance and How Does it Work?

The FIRE Movement

What is FIRE and how does it work? In the world of personal finance, FIRE stands for Financial Independence Retired Early, or some variation thereof and there is a growing movement behind this concept.

Within the FIRE Movement, one is considered to be FIRE, or FIRE’d, when their living expenses can be covered by their investment returns. At that point, you are financially independent (FI) and can retire early if you so choose (RE) because work is optional for you.

But FIRE is so much more than budgeting, investments, or a math equation. FIRE is a way of life and a growing movement that is spreading across the globe and being embraced; not because people suddenly love budgeting and personal finance but because FIRE provides hope.

For anyone that’s ever felt trapped by the thought of a working career that could last into their late 60’s or early 70’s, FIRE provides a feasible alternative to the traditional path that society peddles. And once embraced, the idea of reaching financial independence and retiring early is nearly impossible to snuff out. That’s because, at its core, FIRE is reclamation of one’s personal freedom.

And people long to be free.

What is FIRE Finance and How does FIRE Work?

The actual meaning of FIRE is open to interpretation and varies depending on who you are talking to. “What’s your why?’ is a common question among those seeking FIRE; your answer being the definition of what FIRE means to you.

For some that means a life of travel. For others it means spending more time with their spouse, kids, pursuing a hobby, starting a business or just taking their current job and shoving it.

While FIRE means something different to everyone how you get there (i.e. how you FIRE) has a mostly agreed upon formula.

The Simple Math That’s Fueling the FIRE Movement

The FIRE elevator pitch goes something like this, “When your investments generate enough money to cover your annual expenses you’re financially independent (FI). At that point work is optional and you can retire early (RE) if you want to.”

The FIRE movement is made up of two very simple rules of thumb that FIRE seekers use to determine when they will reach financial independence and can retire early.

- The Rule of 25 helps you estimate how much money you’ll need to have saved and invested in order to retire.

- The Four Percent Rule helps you determine how much of that portfolio you can spend each year without (in theory) running out of money.

Most FIRE proponents use a combination the 4% Rule and the Rule of 25 as the mathematical foundation from which they build their early retirement portfolios.

While the term ‘4% Rule’ is often used as an all-encompassing term for both rules they are in fact different. By themselves both of these financial rules are fine, but adding the two together is what creates the spark that ignites FIRE. Here’s how they look together:

The Rule of 25 (a.k.a. The Multiply by 25 Rule)

The Rule of 25 (also know as the Multiply by 25 Rule) attempts to define how much money you’ll need to save for your retirement. Not surprisingly, based on the name of the rule, that amount is 25 times your annual expenses (not income).

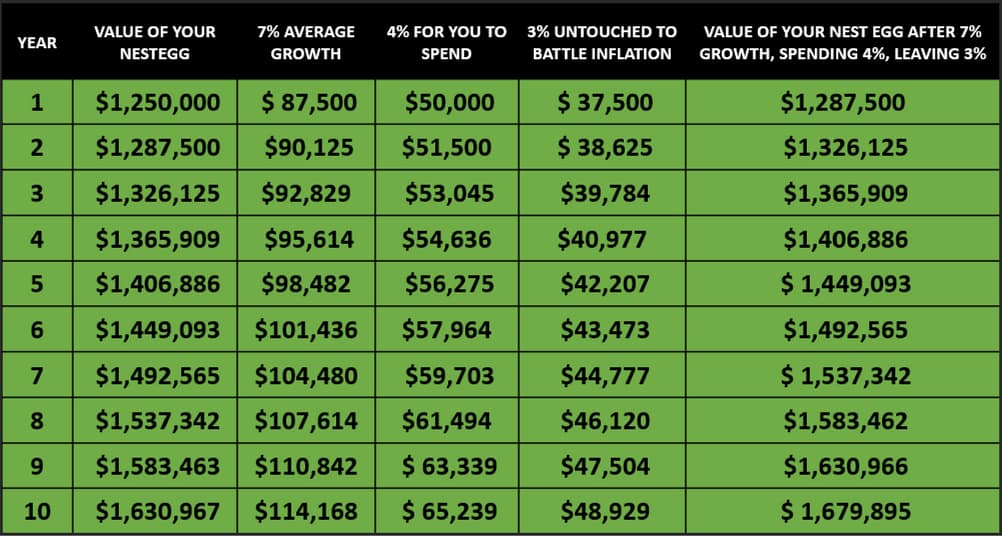

If you spend $50,000 per year multiply that amount by 25 and you’ll come up with a figure of $1,250,000.

In this example, our person would need to save up $1.25 million dollars to build a nest egg large enough to support their spending of $50,000 per year. FIRE seekers use this math as their financial finish line, but that’s not where the numbers end. After all, you’ll need that money to outlast you so that you don’t go broke in retirement.

To make that happen your money needs to be invested so that it can grow and outpace inflation. Low cost index fund investing is the most popular investment strategy you’ll hear about in the world of FIRE. All examples you see in this article are assuming that your money is invested in the US Stock Market.

The 4% Rule (a.k.a. The Safe Withdrawal Rate)

The 4% Rule is the math early retirees use to figure out how much of their portfolio they can spend without ever running out of money. Not surprisingly, based on the name of the rule, that amount is 4%.

On average the U.S. stock market grows at 7% each year. Some years the growth rate is much higher than 7% and some years the market loses value. However, over time this averages out to 7% growth annually. The 4% Rule says that from your 7% growth you’ll be able to spend 4% and leave the remaining 3% invested in order to keep up with the average rate of inflation. In theory, you’ll never touch your principal investment, only a portion of the growth.

As you can see from the table below, if you spend only 4% of your portfolio’s growth and leave the remaining 3% invested you’ll have enough money to live on for the rest of your life, while keeping up with inflation.

The Stock Market Always Goes Up

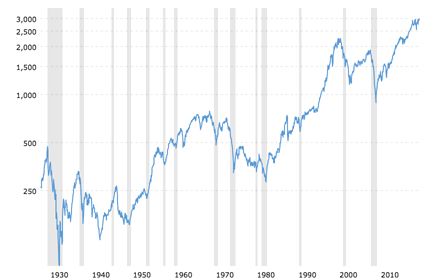

This is possible because the US Stock Market always goes up over time. Always. This happens because there is a limit to how much damage one company can do to the stock market (i.e. a company can only fall to $0, at which point it goes away), but there is no ceiling on how much value one company can contribute.

Bad companies will go away (Radio Shack) while solid companies will stick around (Amazon, Microsoft, Apple). This is why over time the stock market will always go back up! Sure this upward march looks more like an EKG machine and less like an up-moving escalator, but the trend is very clear: up and to the right.

Source: Macrotrends – S&P 500 Index – 90 Year Historical Chart

How to FIRE

Once your living expenses can be met by the revenue generated from your retirement portfolio, then you’re financially independent and an early retirement is an option, if that’s what you’re looking for.

Not everyone should pursue an early retirement, but everyone should pursue financial independence.

To become financially independent those seeking FIRE attempt to maximize the following three areas:

- Reduced spending

- Increased income

- Maximized savings rate

How Long Does it Take to Reach Financial Independence?

The time it takes to FIRE depends on two primary factors:

- Your annual expenses. Naturally the more money you need to get by, the more money you’ll need to save. Inversely, if you can survive on less you don’t need to save as much.

- Your savings rate. If for some reason you can’t save any money your savings rate is 0% and you’ll never reach financial independence since you’ll always require a paycheck to get by. On the other end of that example is someone who can save 100% of their paycheck. That person doesn’t need income to get by, and is financially free.

The trick is to find your healthy balance. Those seeking FIRE are always looking for ways to make more money, reduce their expenses, and increase the percentage of money they’re able to save. Just search around on this blog and you’ll find numerous posts, videos, and articles on each one of those topics.

Calculating Retirement Costs

Another way to look at this is to think about your expenses on an individual level. For example, suppose you need $100 per month to cover a cell phone bill. We can use math from the 4% Rule and the Rule of 25 to calculate exactly how much of your portfolio that $100 per month will account for.

There are two formulas you can use to get that number.

- Annual expense divided by 0.04 (in the case of our $100 cell phone bill, that’s ($100 * 12)/.04 = $30,000

- Annual expense multiplied by 25 (again, using our cell phone bill, that would be ($100*12)*25 = $30,000

Or you if you don’t want to do any math you can use this calculator:

- To use the calculator start by entering the amount of your expense in question (by default this is $100).

- Next, use the drop down menu to choose whether this expense is daily, weekly, monthly or yearly.

- Finally, use the slider at the bottom of the calculator to choose your safe withdraw rate. 4% is the default, but some plan on withdrawing more or less from their portfolio. Pick the SWR that works for you.

What Do You Think?

After playing with this simple calculator, were you surprised to see how much your monthly habits and payments will cost you in retirement? If so, ask yourself if you’re willing to to save and invest the amount of money necessary to support that expenditure in retirement.

Types of FIRE

Some FIRE seekers can’t wait to ditch their full time job while others love what they do and don’t have any intention of retiring early. Different strokes for different folks. Within the FIRE Movement the two most widely talked about types of FIRE are Fat FIRE and Lean FIRE.

Fat FIRE

Fat FIRE is a traditional retirement and those pursuing it have no intention of lowering their standard of living in order to retire early. This just means that Fat FIRE seekers will need to save and invest a bit more than someone that’s trying to retire as fast as possible.

Using our car example from above, someone seeking Fat FIRE would keep their second car and simply add another $225,000 to their portfolio in order to afford that second car in retirement.

Lean FIRE

Lean FIRE is when you cut your expenses drastically in order to lower your annual cost of living. You live a lean lifestyle and are planning on a lean retirement.

Reducing your lifestyle decreases the amount of money you’ll need to have invested before you reach financial independence. That also means that you’ll have less money to live on after you’ve retired. For people seeking Lean FIRE, freedom is more important than lifestyle.

Going back to the car example one last time, Lean FIRE seekers would definitely remove the second car from their life.

Problems With FIRE, The 4% Rule and the Rule of 25?

The math behind FIRE is simple, but some question using the 4% Rule since it wasn’t designed for early retirees.

Originally the 4% Rule was created to identify a “safe withdraw rate” that ensured a retirement portfolio could survive 30 years. The problem with applying this rule to FIRE is that many early retirees need their portfolio to last double that. Can the 4% Rule hold up over a 60 year period?

The answer is, yes. Most of the time.

But “most of the time” isn’t very comforting when you’re talking about your retirement. Flexibility might be required to increase the surviveablity rates of a portfolio and those seeking FIRE understand this.

Fire Flexibility

While it’s true that the 4% Rule wasn’t designed with the early retiree in mind, it should also be pointed out that the 4% Rule also assumed that you’d NEVER spend less than 4% of your portfolio per year. It also assumed that that you’d never, ever add a single penny to your portfolio once you retire.

With a couple of adjustments most concerns that people have about the 4% Rule can be nullified. Applying some combination of the following solutions to their retirement plans should be enough for the early retiree to ride out any financial storms that come their way:

- Saving more than 25 times your expenses (many aim for 33 times)

- Spending less than 4% of your portfolio during a down market (3% – 3.5% are popular estimates)

- Earning money during retirement (via hobbies or side hustles)

To Retire or Not to Retire? That is the Question!

While FIRE means something different to nearly everyone, most everyone agrees that the FI is more important than the RE.

Financial independence isn’t about money or retiring early, it’s about reclaiming your time and doing what you want with it. It’s about no longer being a wage slave dependent upon that paycheck for stability.

Who Can FIRE?

The FIRE movement is made up of people that have already retired early, but most people pursuing financial independence are still grinding away at their 9 to 5. Some of these people make well over $100,000 per year; many of them are married to other six figure earners.

But FIRE seekers are also made up of couples that DON’T earn huge incomes. There are single income homes where the breadwinner is pulling down a teachers salary. There are individuals that work in all fields across all industries.

Financial Independence > Early Retirement

Many FIRE seekers are extremely driven to achieve that freedom from a paycheck. Yet, for many, that same drive that helps them achieve financial independence at an early age also means they may have no desire to retire early.

Or ever.

Not everyone should pursue an early retirement, but everyone should pursue financial independence.

— Camp FIRE Finance 🔥 (@CampFireFinance) June 1, 2018

A financially independent person works because they want to, not because they need to. It’s not a stretch to assume that someone working because they want to brings more passion to their work and gets more enjoyment from their labors.

If you’re fulfilled by your work and don’t need to make money from it, why would you ever leave it?

A FIRE’d person doesn’t need to. That’s why not everyone seeking FIRE is seeking an early retirement.

Interested in FIRE?

You can retire earlier than you think. You just need to start thinking differently.

Interested in the FIRE movement? Sign up for Kindling and get our FIRE-related content emailed to you each morning. You’ll also receive access to our FIRE calculator when you sign up.