Your Break Even Point is the Best Day of the Month. Do You Know When it Is?

Your financial Break Even Point is the best day of the month, and you probably don’t even know when, or what, it is. That’s a huge mistake. Understanding your Break Even Point can help you reach financial independence sooner.

We believe in the number so much that we just developed a Break Even Point calculator so that you can quickly and easily figure out your number, and then get to work fixing it! So read on, determine your financial break even point and tip the financial scales in your favor.

WHAT IS A FINANCIAL BREAK EVEN POINT?

Every single month you start off in a financial hole because of all the debts and financial obligations you have which must be paid for. At a minimum, you’re on the hook for the following budgets items:

- Food

- Shelter

- Clothing

You most likely have a few other things working against your budget as well. Things like:

- Cable TV

- Car payments

- Student loans

- Cell phone bill

- Magazine subscription

- Alimony or child support

- Netflix

You get it. The list of financial obligations that can weigh you down is as long as it is unique.

Your Break Even Point is the moment at which you get to keep the money you make because you’ve finally met all of your financial obligations. Picture a set of scales that are not in balance. The scales begin each month out of balance and your Break Even Point happens at the moment the scales finally become balanced.

From that point forward, the scales are tipped in your favor and that’s when you can make financial magic happen!

HOW CAN THE BREAK EVEN POINT HELP ME?

Once you know your Break Even Point you can begin working to tip the scales in your favor. Until you hit your BEP, every single penny you make belongs to someone else. But once the scales have tipped in your favor, after you’ve hit your BEP, everything you earn is yours to keep.

Knowing the exact time and date when the scales tip in your favor is HUGE because you can then begin to work on improving the amount of time is takes you to reach it.

Knowing your Break Even Point allows you to think differently about how all future purchases and other financial decisions tip the scales. Once you know this you can set a goal to start changing the break even point in your favor. Can you shave a day off your BEP? A week? More!?

HOW TO CALCULATE YOUR BREAK EVEN POINT

Calculating your BEP is quick and easy. All you need to know is your total monthly expenses and the amount of money you make per hour at work.

I know that some of you have dual incomes and some of you (like me) have just one income. Many of you combine your expenses while others keep them separate. You’ll need to tweak the numbers to fit your own situation, but for the sake of this example, I’m going to assume the following:

- Assume I have $3,000 per month in total expenses

- Assume that I make $52,000 per year

- Or $25 per hours (assuming the typical 40 hour work week; $52.000/2,080 hours = $25/hr)

With those two data points, here’s how to calculate your Break Even Point: Take my $3,000 in expenses and divide that by my $25.00 per hour rate.

- $3,000 / $25.00 = 120

120 is a measurement of time. In other words, I need to work 120 hours every month just to cover my expenses. 120 hours is my BEP.

Assuming an 8 hour work day, I need to go to work for 15 days just to meet my financial obligations; to break even.

In an average work month there are about 21 work days. If I’m spending 15 of those days working just to break even, that means I only have 6 days per month that benefit me. In this example, 71% of my time is spent working just to pay the bills.

So my Break Even Point in this example is 120 hours. 15 days.

USE OUR BREAK EVEN POINT CALCULATOR

Enter your own numbers into this calculator to find your financial break even point. Note: If your not sure what percentage of your paycheck gets withheld, just use 20%. The average paycheck in the U.S. has about 20% withheld for things like federal and state taxes, social security and medicare, so we’re using 20% as the default number here.

Break Even Point

$

Input either your hourly wage or your annual salary

$

$

HOW TO IMPROVE YOUR BREAK EVEN POINT

Now that you know what your Break Even Point is, the challenge for you is to start pulling that date forward. The smaller you can make that number, the more of your time you can reclaim. You can change you Break Even Point in three ways:

- Reduce your expenses

- Increase your income

- Reduce your expenses AND increase your income

Reducing your expenses is the quickest way to begin tipping the scales in your favor. Get rid of all unnecessary expenses. Check out this list of unusual ways to save money. Do whatever you can to reduce your expenses so that you can pull your Break Even Point forward to earlier in the month.

While reducing expenses is the quickest way to make progress, increasing your income will make a bigger impact than cutting out Starbucks. But increasing our income isn’t always easy.

If you’re tapped out at work, try a side hustle (here’s our growing list of side hustles you can check out), or maybe even get a second job if possible. Increasing the amount of money you make means you can reach BEP faster than you can today.

Ideally you’ll find a way to reduce your expenses AND increase your income. Talk about the Personal Finance Multiplier Effect in action! Essentially you’d be simultaneously working both ends of the scales to your advantage.

WHAT GETS MEASURED GETS IMPROVED

Anything you can do to make your BEP smaller is a win that works in your favor. But on the other side, every debt or financial obligation that you take on makes your Break Even Point bigger.

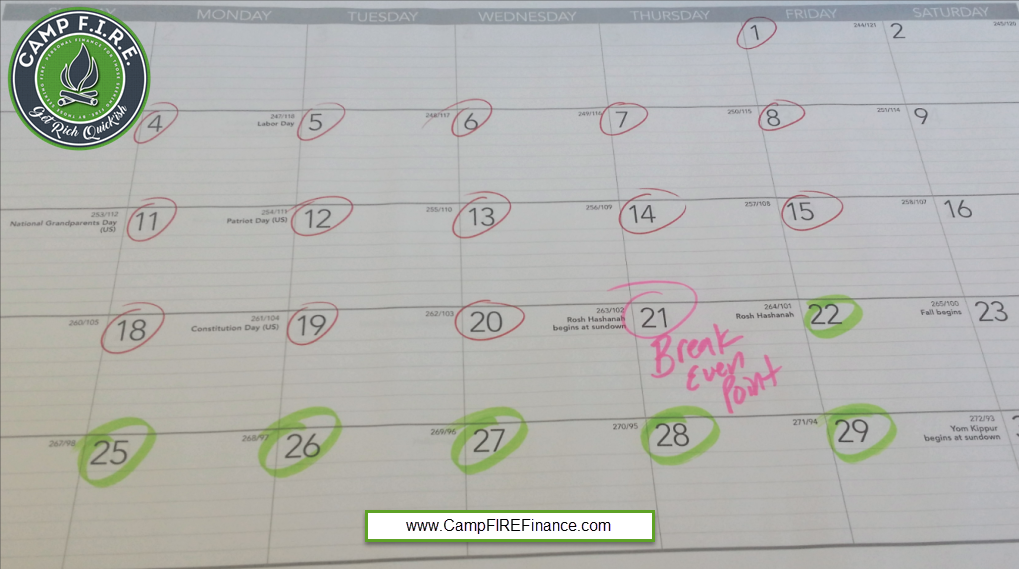

Take 5 minutes today to calculate your Break Even Point. Circle it on your calendar each month. Have a mini-celebration each month whenever you pass your BEP. Then get to work busting your butt to tip the scales in your favor so that your party comes earlier every month!

Chime in!

What’s your Break Even Point? Are you up for trying to change it? Do you think this Break Even Point calculation can help you out? Let me know in the comments.