How to Build a Money Making Machine That Will Pay For Your Early Retirement

Generally speaking, wealthy people get and stay rich because they make smart decisions with their money. They create a money making machine by purchasing assets, not liabilities. An asset makes you money, a liability costs you money. Successful people buy assets like real estate, fine art, and businesses. But what if you are not good at business?

WHAT IS A BUSINESS?

One way for you to reach financial independence is to start a successful business of your own. Easier said than done, right? Some estimates claim that up to 9 out of 10 new business fail to last even just a few years.

Forget those failure rates for a moment, maybe you’re just not the entrepreneurial type and have no desire to start a business or think you can’t start a successful business. If that’s what you think, then your thinking is wrong. You absolutely CAN start a successful business, you just need to look at things differently:

A BUSINESS IS NOTHING MORE THAN A MONEY MAKING MACHINE

Every decision a business owner makes should result in their business, their money making machine, cranking out more money than before that decision was made. For example:

-

Business owners hire employees not because they’re running a charity and want to hand out paychecks, but because they believe those employees will end up helping the business make more money than if nobody had been hired at all.

-

A sales person is expected to generate more revenue for the company than their salary costs the company. If that sales person costs more money than they generate, guess who is losing their job?

-

An executive assistant is hired not because the executive is lazy. The assistant is hired to keep the executive organized and to free up the executive’s time so that she can focus on areas of the business that will generate money, rather than on handling administrative tasks. It’s a business decision that should result in the business making more money. Nothing more. Nothing less.

So, a business is nothing more than a money making machine, and every decision a business owner makes should result in the machine generating more money. If the machine doesn’t make money, it goes out of business.

NOT GOOD AT BUSINESS?

If you’re the type of person that doesn’t have the time, skill, know-how, desire, or whatever to start a “traditional business” then I’ve got the perfect solution for you. What I’ve got in mind is a business that you can easily start today and make money at tomorrow, with little time and money required to get going:

YOUR BUSINESS IS BUYING STOCK

Think about it for a second. Or maybe you are thinking about it and you’re thinking “Buying stock? That’s not a business, you moron!”

Why not? A business is nothing more than a money making machine and your machine isn’t a widget maker, or a trendy food truck, or a manufacturing plant, or anything else like that. Your business is to stockpile as many stocks as you possibly can.

Don’t have a lot of money? No problem – just don’t buy a lot of stock. You can buy just one share at a time, or you can buy several million dollars’ worth. The number of shares you purchase doesn’t matter. What’s important is that you get started.

The best time to plant a tree is 20 years ago. The second best time is now. – Chinese Proverb

HOW TO CREATE A MONEY MAKING MACHINE USING STOCKS

Stocks make money in two ways, through dividends and appreciation. A dividend is a payout from a company to its shareholders. Appreciation is when the price of a stock climbs higher than the price you paid; when you sell, the difference is your profit.

Your business could be nothing more than buying portions of other peoples’ businesses in the form of stock. But what stock to buy? Rather than trying to pick ‘winning stocks’ or buying individual stock from companies you’re familiar with, you should instead buy pieces of every company that is traded on the stock market.

You do this by purchasing an index fund that tracks the entire U.S. stock market. A popular index fund is called the Total Stock Market Index Fund and it is managed by Vanguard.

Created in 1992, Vanguard Total Stock Market Index Fund is designed to provide investors with exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks. The fund’s key attributes are its low costs, broad diversification, and the potential for tax efficiency. – Vanguard.com

When you buy one share of the Vanguard Total Stock Market Index Fund you are literally buying a small fraction of every single company traded on the U.S. market.

At the time I’m writing this (3/6/2016), the cost of one share of VTSMX (the symbol for Vanguard’s Total Stock Market Index fund) is $49.68. For less than $50 bucks you can own a piece of nearly every company traded on the stock market. How cool is that!

RISKY BUSINESS?

But socks are too risky, right?

Wrong.

Buying individual stocks is what is risky. Consider this: 88% of the Fortune 500 firms from 1955 are gone! Only 61 from the 1955 Fortune 500 list are still on that list today.

Gone are former stalwarts like American Motor Company, Studebaker, and Zenith. More recently, other high profile companies that have filed bankruptcy or are totally out of business include Radio Shack, Sports Authority and we can’t forget about the poster children for corporate fraud and failure, Arthur Anderson and Enron.

Here today, gone tomorrow. Today’s blue chips are tomorrow’s cow chips. New giants on the market today might be Facebook, Microsoft, Amazon. But will they be around in 60 years? The odds say that they won’t be.

But they could be, who knows?!

Nobody knows!!! That’s exactly why individual stocks are risky and that’s exactly why it’s a safer bet to invest in the U.S. stock market as a whole through index funds. Unsuccessful businesses like Enron, Radio Shack, American Motors Company, and Compaq get replaced by new, exciting companies like Apple, Facebook, Amazon, Microsoft.

Companies like Boeing, IBM, General Motors, Proctor & Gamble were on the Fortune 500 in 1955 and are they are still there today. Nice work, guys! Every year these companies grow and become more valuable while the companies that stop making money go away.

THINGS ARE LOOKING UP!

And this right here is the beauty of the stock market as a whole: There is a limit to how much damage one single company can do to the stock market, but there isn’t a ceiling to how much value one company can add. Bad companies go away. Solid companies stick around and keep growing. That’s why, over time, the stock market always goes up!

The point is that nobody can pick the winners and losers on a consistent basis. So instead, why not invest in the entire market as a whole. True, you’ll never hit the “home run” by investing this way, but you’ll never lose your shorts either.

Yes, there absolutely is risk in the stock market. It can be a wild ride for sure, but it’s actually a safe long-term investment that grows, on average, at about 7% per year annually after adjusting for inflation.

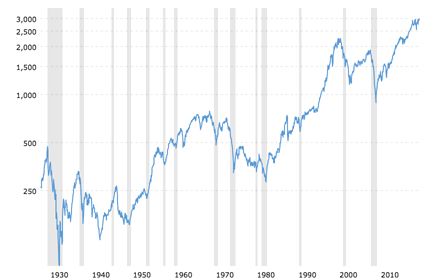

UP AND TO THE RIGHT

This chart shows the stock market’s growth from its beginning through today. This includes the Great Depression, the Great Recession, WWII, 9/11, and several other scary and perilous times in America’s history. Lots of ups and downs in the market, but an unmistakable, relentless march upwards. It’s actually quite amazing.

Source: Macrotrends – S&P 500 Index – 90 Year Historical Chart

Let’s say that again, just to be crystal clear: the stock market is like an EKG machine and not like an up-moving escalator. Some years the market as a whole will not only miss the 7% growth rate, but it will actually lose value. Yikes!

If you’ve got your hard-earned dollars invested in a total market index fund then that’s scary! But don’t panic just yet because during other years your investments will grow at a MUCH greater rate than 7%. It all averages out over time.

So this isn’t a smooth ride, but neither is owning a traditional business. As a traditional business owner you might put in regular 80 hour work weeks and everything ultimately falls upon your shoulders. Being a business owner is stressful whether you’re making widgets or buying stock.

It’s not easy. If it were then everyone would do it. But you’re not like everyone else. So start planting those trees today and twenty years from now you’ll be glad you did!

A Note

It shouldn’t have to be said, but I’ll say it anyway. You wouldn’t start a business manufacturing widgets without doing a bit of research. Likewise, you wouldn’t buy fine art without educating yourself a bit on the art world. You shouldn’t jump right into the stock market if you know nothing about it. If you feel like you know what you’re doing, then jump on in! If you don’t then take a bit of time to educate yourself.

This book The Simple Path to Wealth, by Jim Collins, is a great place to start. I both own this book and refer to it often; I highly recommend picking it up … it could be one of the best financial decisions you ever make!

Chime in! Do you think owning stocks is like owning a business? Does this idea resonate with you? Please leave a comment and let me know.