5 Outdated Financial Rules that Need to be Broken

These outdated financial rules were created by previous generations, but no longer hold true in today’s world.If you’re interested in achieving financial independence and early retirement then you need to consider breaking these 5 outdated financial rules.

Outdated Financial Rules

There are very few universal truths within personal finance, yet some ideas have persisted for so long that they’re now looked upon as financial rules that must be followed in order to succeed financially.

Take a look at these five outdated financial rules and see if you agree that these rules need to be broken.

1. Cash is Safe

Cash is what humans use to simplify the barter system. No longer do fishermen exchange their catch for fresh fruit. Instead, we all rely on and trust the cash system.

For millennia people have exchanged their goods and services in return for money, which was distributed in the form of precious metals, jewelry or other rare objects. In modern times, people rely on banknotes, or cash, to exchange value. I trade you my cash in exchange for your goods or services. It’s a win-win.

Why this rule exists

Since money is what we use to barter, it’s naturally very valuable, and people tend to protect their valuables. Nobody wants to lose their hard earned cash, so we protect it and keep it safe. Today, people feel their cash is safest in a checking or savings account at their local bank or credit union.

In previous generations one could expect to earn a respectable rate of return by parking cash in a savings account. That idea has persisted and today, checking and savings accounts are the go-to solution for the majority of us to hold our cash, regardless of the low interest rates paid by these accounts.

Why this rule needs to be broken

Cash is a great invention, but a terrible store of value because of inflation, which robs you of about 3% of your buying power each year. Think about the house your grandparents (or great grandparents) purchased for $3,000 in the 1940’s. Today that same house would cost PopPop and Nana about $200,000 thanks to inflation. Same house. More expensive today. That’s the time value of money.

A dollar tomorrow is worth less than a dollar today. And the longer you hold onto cash, the less valuable it becomes and that’s why you need to break this outdated financial rule.

Buying power and inflation rate by year data from Bureau of Labor Statistics

How to break this rule

You can escape the corrosive clutches of inflation by putting your cash to work. It doesn’t even need to work terribly hard. It just needs to earn an average of 3% annually to keep up with inflation. Anything over 3% means your cash will be more valuable in the future than it is today.

The best way to put your cash to work is to invest it. Investing in index funds is the simplest way to invest. Other ways to invest your money is to buy real estate or to start your own business. Whatever you do, break this outdated financial rule and start to invest your cash rather than holding onto large chunks of it.

2. The Stock Market is Risky

Stock markets as we think of them today trace their origins back to 1400’s Antwerp, Belgium. The world’s first publicly traded company was the East India Company. Shipping at that time was incredibly risky … too risky for one company to assume all the risk. So the “Governor and Company of Merchants of London trading with the East Indies” corporation was formed; this was the East India Trading Company.

Risk and the stock market, together from the very beginning. The stock market is a way to share risk. And reward!

Why this rule exists

The free market is very competitive and companies that can’t keep up with their competition get left behind. This also applies to publicly traded companies. Even “blue chip” stocks from well known, often international companies, that typically offer lower risk to investors, aren’t immune to getting left behind. Consider this: 88% of Fortune 500 firms from 1955 are gone! If you invest in a company that can’t keep up, then you’re going to lose some or all of your money.

Layer in the fact that most people don’t understand how the stock market works to begin with, and it’s no surprise at all that many people assume that “stocks are too risky.” So instead they keep their money ‘safe’ by putting it in a savings account (see rule #1 above).

Why this rule needs to be broken

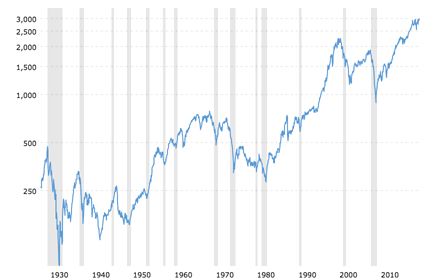

While individual stocks can indeed be risky, the stock market as a whole is quite safe. In fact, the stock market has always gone up. Sure, there are peaks and valleys along the way, but the trend is unmistakable: up and to the right.

S&P 500 Index – 90 Year Historical Chart [Source: Macrotrends]

The stock market is one of greatest (if not the greatest) creators of wealth for the general masses in the modern era. But too many have missed out on growing their wealth because of a fear that the stock market is just too risky.

How to break this rule.

Since 1976 index funds have been helping people mitigate their risk by allowing them to invest in the stock market as a whole, rather than individual companies.

The stock market, on average, grows at about 7% per year, and index funds track to this average. Sure, you’ll never hit a home run by investing in index funds, but you’ll never crash and burn either.

Avoid picking just individual stocks and instead, index and chill.

3. Renting Your Home is Like Throwing Away Money

For generations, pop culture has propped up the suburban residential home with a white picket fence and a two car garage as the ultimate symbol of status and success. Home ownership was a cornerstone of The American Dream. And wise financial advice to boot!

After all, the home is your biggest investment and renting is throwing money away, right? That’s been the consensus for a few generations now, but a growing number of people have come to the realization that home ownership isn’t all that, and it’s no longer essential American Dream – financial independence is.

Why this rule exists

From generation to generation, the same advice has been passed down: buy a home, don’t rent. For many, their home was also their greatest source of wealth. Real estate has been viewed as one of the safest investments available. And for those leery of investing in the stock market, it was easy to look at home equity that had been building for decades and think, ‘this is a great investment!’

Why this rule needs to be broken

Because your home is your home, not an investment (to be clear, this rule isn’t for real estate investors – this if for those that treat their primary residence as an investment). If you’re looking for a place to invest the majority of your wealth, there are simpler places to so.

How to break this rule

Not everyone *should* break this rule. Buying makes sense for many, but so does renting. You need to analyze your own situation, run your own numbers and determine if renting or buying makes sense for you. And you should also read Renting is Throwing Money Away … Right? from Afford Anything today. This is hands-down the best Rent vs. Buy article I’ve ever found.

4. College is Required

Almost every single office job, or white collar job description you read includes some variation of the line “college degree required…MBA preferred.” Because many of these jobs are also high-paying, it’s no wonder so many are flocking to college, taking on student loans to pay for their education. Employers demand it.

It’s easy to see this and feel like a college education is the only way to secure a good salary and a secure future. That’s nonsense.

Why this rule exists

Just a few generations ago graduating high school was rare, whereas today it’s the norm. In the past, when the masses were all competing for the same blue collar jobs, one way to increase your chances of escaping to the middle class was through college. Parents that wanted the best for their children pushed this idea. And it worked for a great many! Today, more than than 1 in 3 people have an advanced education and the middle class is bigger than ever.

America’s Education: population 25 and Older by Educational Attainment [Source: U.S. Census Bureau}

Why this rule needs to be broken

College is not the only path to a middle class (or greater) salary and lifestyle. Especially when the cost is so high. Teenagers, whose brains haven’t yet fully developed, are signing up for levels of debt they can’t even comprehend. Allowing kids to sign up for this much debt ought to be discouraged, instead, it’s encouraged.

Meanwhile, millions of high-paying jobs go unfilled in the skilled trades. Jobs like plumbers, mechanics, electricians, welders, etc. pay $45,000 – $60,000 per year. In Seattle, the *average* heavy equipment operator makes more than $95,000 per year in salary and benefits, according to Salary.com.

Don’t get me wrong, a college education is a wonderful thing. And that education no doubt leads to many fantastic opportunities. But when a college degree leaves you saddled with debt approaching six-figures, and you’re unable to find a job that lets you pay that debt off in just a few years, then something has gone wrong.

How to break this rule

You’ve got two options.

1. Go to college on the cheap. Start by attending a local community college and live at home as long as possible. Work part-time to help pay for school. Take longer than 4 years to complete your degree if necessary, just do whatever you can to avoid taking out a crushing amount of student loans. (If you already have them, doing a student loan refinance could be an option.)

2. Skip college and go to a trade school, or become an apprentice and learn one of the skilled trades while you’re on the job and getting paid.

Society’s plans work for many, but they aren’t the only way to lead a happy and successful life. Financing your education is just another example of this – taking out student loans to get a college degree is not the only path to financial success.

5. Retirement Age is 65

Retirement is a modern idea, first proposed by the Chancellor of Germany, Otto von Bismarck, in 1889. Understanding that, I suppose we should be grateful that we have the opportunity to retire at all. But life is short, and most of us don’t want to spend the best years of our lives punching a clock. So if an alternative is available that allows you to retire even earlier, wouldn’t you want to know about it?

Why this rule exists

Most people peg retirement to age 65 because that’s when you can claim your social security benefits from the government and/or pension benefits from your employer. Not surprisingly, as soon as someone had a stable source of income outside of a full time job, they retired. The only problem is that when the concept of social security was first introduced, life expectancy didn’t go past 50 years old anywhere in the world.

This is an interactive chart. Use the blue slider at the bottom to see what life expectancy was around the world at different times.

Why this rule needs to be broken

Because life is short and most of us don’t get a great sense of purpose or satisfaction from our jobs. Life expectancy today has climbed into the 70’s and 80’s, but the idea of working full time for 40+ years only to enjoy the last 10 years of life (when mental and physical health will likely be on the decline) isn’t an idea that many will get behind if they don’t have to.

How to break this rule.

Thankfully, the principles preached in the FIRE movement teach us exactly how to break this outdated financial rule:

With a little planning and conscious spending, many people can build a retirement portfolio capable of supporting a retirement in about 10-15 years. Depending on when you start your journey, you could retire as early your 30’s, easily in your 40’s and definitely in your 50’s.

If you got off to a late start on your retirement planning, or if you find yourself in a deep financial hole, then the principles of FIRE Finance can help you retire on time.

Update Your Financial Rules

If you’re still following these outdated financial rules then you could be adding years, possibly decades, to your working career. But if you’re interested in achieving financial independence and an early retirement, then breaking these outdated financial rules could help you achieve your financial goals earlier than you thought possible.

Chime In!

Thanks for reading! Now it’s your turn. What other financial rules exist that need to be broken?