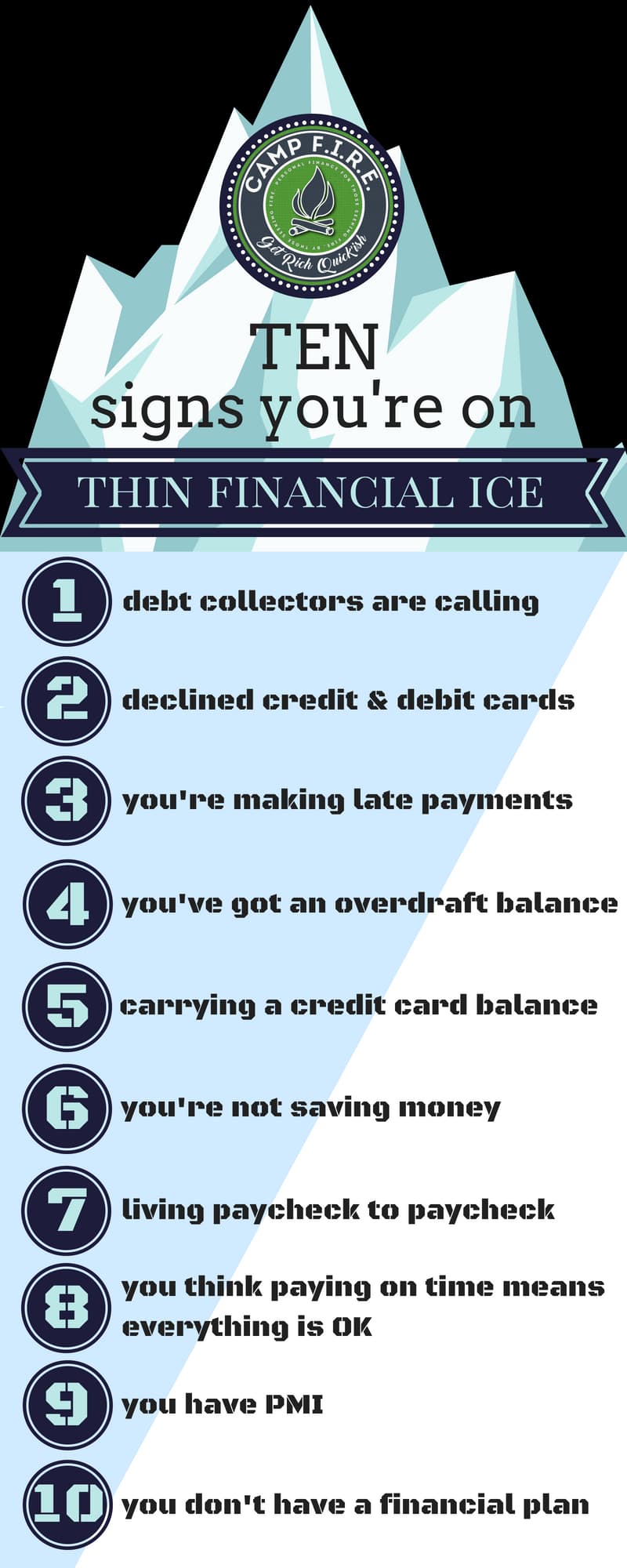

10 Signs You’re On Thin Financial Ice

Have you got a steady income and can afford to pay your bills each month, yet you’ve got an uneasy feeling that you’re headed for some financial trouble? The first sign that you’re on thin financial ice is that you think paying your bills means that everything is good.

10 SIGNS THAT YOU’RE HEADED FOR FINANCIAL TROUBLE

While not an all-inclusive list by any means, these are 10 signs that you might be on thin financial ice. From most ominous to least, these are 10 Signs That You’re On Thin Financial Ice.

1. YOU’RE AFRAID THAT PHONE CALL MIGHT BE FROM A COLLECTION AGENCY

Not sure if that unknown phone number is from your kid’s school or a bill collector? If the collection calls have started, or if you’re worried they might be starting soon, then you’re in trouble. If you listen carefully you can hear the ice beneath your feed creaking and cracking.

WHAT CAN YOU DO ABOUT IT?

First, the one thing you shouldn’t do is ignore the problem. It will only get worse (far worse). So answer the call. Work out a payment arrangement. Try to put the loan on deferment. Here’s a list of unusual ways to save money; can any of these ideas help free up some money so that you can pay your late bills and stop the collection calls?

2. YOU’RE AFRAID YOUR CREDIT OR DEBIT CARD WILL BE DECLINED WHEN YOU SWIPE IT

If you’re secretly worried about your card declining each time you use it, then you can stop wondering if you’re on thin financial ice – you are on it. That deep groaning noise you hear is the ice starting to crack. Put the card away. If you don’t know if you have money, you shouldn’t be using your card.

WHAT CAN YOU DO ABOUT IT?

Know how much money (exactly how much money) is in your account. Know what’s scheduled to come out. Track your spending so that you know where every single penny is going, how much money you’ve got so that you can identify areas where you can cut back your spending.

3. YOU’RE GETTING LATE PAYMENT NOTIFICATIONS

If you’re starting to receive notifications that your payment is late and about to incur a fee, you’re on ice that is thin, and rapidly melting. If you don’t do something to fix your situation it will quickly go from bad to worse.

WHAT CAN YOU DO ABOUT IT?

Create a budget. Today. A budget DOES NOT restrict you, just the opposite – it allows you to soar! A good budget will not only help you track your spending, but will also help you avoid late payments.

4. YOU’VE GOT AN OVERDRAFT BALANCE ON YOUR CHECKING ACCOUNT

Uh oh – you’ve spent more money than you have and the bank had to step in to loan you money. Now you owe them, yet you clearly don’t have any money to pay them back.

WHAT CAN YOU DO ABOUT IT?

Spend less money than you make. That’s a guaranteed way to never incur overdraft fees again. Consider removing the overdraft protection from your account or, at the very least, lower your overdraft limit down to $100. Oh, and pay off that balance as soon as possible!

5. YOU CARRY A BALANCE ON YOUR CREDIT CARD(S)

This is where the slope starts to get very slippery. Credit cards can trick you into living a life you couldn’t otherwise afford to live. If you use credit cards but can’t afford to pay off the balance in full each month, then you can’t afford to be using the credit card! All you’re doing is stealing wealth from the future you – total jerk move.

WHAT CAN YOU DO ABOUT IT?

Stop buying on credit immediately. Look for a 0% interest balance transfer option so that you can pay off your current credit card debt faster. BE CAREFUL! A balance transfer will only help you if you stop using your credit cards. If you do a balance transfer only to run up more debt, then you’ll be in a bigger hole than you started with.

6. YOU CAN’T (or don’t) SAVE MONEY

If you can’t save because there just isn’t any money left to save, I understand your plight. That’s a tough spot to be in, but you’re still on thin ice nonetheless. If you have the ability to save, but don’t – you too are on thin ice.

WHAT CAN YOU DO ABOUT IT?

You either have an income problem, or a spending problem (or both). Start by saving your spare change. Literally. Every little bit helps.

7. YOU LIVE PAYCHECK TO PAYCHECK

Living payday to payday is a bit like being a juggler with a lot of balls in the air. Maybe you’re making it work right now, but at any second a ball could drop and then the party is over. Living paycheck to paycheck doesn’t necessarily mean that you’re bad with money, but it does mean that something needs to change.

WHAT CAN YOU DO ABOUT IT?

Try to act like you’re unemployed as a way to whip your budget into shape, eliminate needless expenses, and build up a cash cushion that will allow you to break the paycheck to paycheck cycle. Do a financial assessment by figuring out how much you make, where each penny goes, what can be cut from your budget, and what needs to stay. With that information you’ll be able to choose what step to take next.

8. YOU BELIEVE THAT PAYING BILLS ON TIME MEANS ALL IS WELL

Paying your bills on time is a good thing – keep it up! But this can also lead to a false sense of security. There are other things to look at besides whether or not you are making your payments on time. Just paying your bills on time might mean your treading water and not making progress.

WHAT CAN YOU DO ABOUT IT?

Don’t just pay on time – make sure you’ve got a debt reduction plan. Here are two popular debt elimination strategies, plus one more that I like. Make sure that you’re also doing something each month to get ahead, like saving or investing in a 401(k) or other retirement account.

9. YOU HAVE PRIVATE MORTGAGE INSURANCE (PMI)

Why is this bad? Because PMI is usually required when you have less than 20% equity in your house and is an indicator that you might have more home than you can afford. PMI can also add a sizeable chunk of cash to your mortgage payment that, worst of all, only protects your lender – not you.

WHAT CAN YOU DO ABOUT IT?

Apply extra money to your loan payment each month until your loan to value ratio is less than 80%. If you’re home has gone up in value, have it reappraised then request PMI cancellation from your lender if you’re equity is now greater than 20%. Lastly, consider a second mortgage. PMI is required only on your primary (first) mortgage. A second mortgage could bring your LTV ration under 80% and would eliminate the need for PMI. But be careful – this is just a shell game and at the end of the day you’d still have a home that you might not be able to afford!

10. YOU DON’T HAVE A FINANCIAL PLAN

Not having a plan doesn’t necessarily mean you’re headed for trouble, but it might. Without a plan, how do you know where you’re headed? Or how you’re going to get there.

WHAT CAN YOU DO ABOUT IT?

Take your next Sunday afternoon to sit down and assess your situation and goals to create a financial plan. Figure out how to (1) Spend less than you earn. (2) Invest that difference. (3) Eliminate, then avoid debt.

Chime in!

Are you standing on ice that’s thick or thin? What’s missing from this list that is also an indicator of trouble? Most importantly, what are you going to do today to improve your situation?